TOP 100 European football clubs by enterprise value

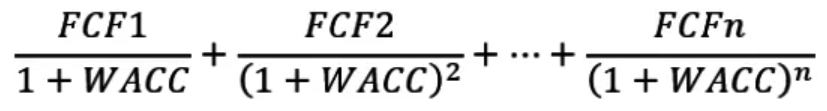

Football is more than just a sport – it’s a massive business. The latest analysis of the Top 100 European football clubs by enterprise value (2021-2024) reveals fascinating trends and shifts at the top of the financial rankings. While the English Premier League (EPL) continues its dominance, clubs like Nottingham Forest and RC Lens have seen extraordinary growth. However, not all clubs are on an upward trajectory – Schalke 04 and Borussia Dortmund face financial challenges.

Biggest Winners: Who Has Grown the Most?

Manchester City has claimed the top spot with an astonishing €5.94 billion enterprise value, driven by smart investments, global branding, and consistent sporting success. Arsenal FC recorded a 154.8% increase, making it one of the fastest-growing clubs in the top 10. Nottingham Forest saw a 419% revenue increase after being promoted to the Premier League, highlighting the power of TV rights and sponsorship deals.

League Dominance – EPL vs. The Rest of Europe

The English Premier League continues to grow and now generates over €7 billion annually, almost twice as much as La Liga. Their commercial model, combined with global popularity, makes them the financial powerhouse of football.

New Entrants & Club Strategies

Besides financial power, innovative strategies are shaping the football business:

- Brighton & Hove Albion and Brentford FC use data analytics and a “Moneyball” approach to maximize squad value.

- RC Lens and Cádiz CF invest in technology and digital strategies to enhance fan engagement.

Conclusion

In modern football, financial strength often translates into success on the pitch. Clubs that effectively balance investments, strategy, and global influence are emerging as long-term leaders.