TOP 100 EUROPEAN CLUBS BY ENTERPRISE VALUE

publicly traded clubs included) without taking into consideration of market capitalization, debt, and cash? Yes, TOP 100 European clubs by enterprise value calculated!

After four months of research, I and my team were dealing with calculations of the enterprise value of TOP 100 European clubs using statistical analysis to find an algorithm that does not use data about market capitalisation, debt, and cash, but data from financial reports.

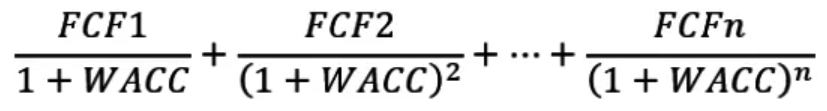

So, what is enterprise value? It is a value you would pay for business if you were aiming to purchase it or, a value you would receive if you would sell your business. The following formula is used to determine the enterprise values of publicly traded businesses:

Enterprise Value = Market Capitalization + Debt (short and long term) – Cash (and cash equivalents)

But what if you want to buy a club which is not publicly traded? There are several methods how for calculating it:

1. Comparable Company Analysis (CCA)

2. Discounted Cash Flow (DCF) method

3. First Chicago Method

4. Asset-based method

All of these methods are in more detail explained on the following link (https://corporatefinanceinstitute.com/resources/knowledge/valuation/private-company-valuation/ ), but one can find a lot of literature on the web.

I will just quote snapshots from definitions:

Ad1. The Comparable Company Analysis (CCA) method operates under the assumption that similar firms in the same industry have similar multiples.

Ad2. The Discounted Cash Flow (DCF) method takes the CCA method one step further. As with the CCA method, we estimate the target’s discounted cash flow estimations, based on acquired financial information from its publicly traded peers.

Ad3. The First Chicago Method is a combination of the multiple-based valuation method and the discounted cash flow method. The distinct feature of this method lies in its consideration of various scenarios of the target firm’s payoffs. (Usually, this method involves the construction of three scenarios: a best-case (as stated in the firm’s business plan), a base-case (the most likely scenario), and a worst-case scenario. A probability is assigned to each case.)

Ad 4. The asset-based method is used when is more profitable to liquidate a firm than continue with business because with liquidation firm will have better cash flow than if it continues with business.

If you don’t know which method to use, help could also be found at „The International Valuation Standards Council” – IVSC or national agencies for evaluation of firms.

In this research, the goal was to assess publicly and non-publicly traded clubs to calculate their enterprise value. Since there is no share price for non-traded clubs, we have been looking for the club’s overall environment which would influence on share price to go up or down. There is a lot of literature about reasons for share price fluctuation generally, but also specifically for the football industry as well. Joao Duque and Nuno Abrantes Ferreira from Instituto Superior Economia e Gestao, Universidade Tecnica de Lisbao have found positive relationship between sporting performance and share price. José Allouche from Université de Paris 1 Panthéon-Sorbonne, Paris and Sébastien Soulez from Université Lumiere Lyon 2, Lyon have found that sporting results positively influence on share price after victory and vice versa. Further on, they have found that managerial decisions about running and investing in sporting facilities, sponsoring and positive financial results influence positively the share price and in case of unfavourable financial results influence negatively the share price. Also, they have found the relationship between human resources (players) and share price. Similar is found in Turkey regarding winning (https://www.jstor.org/stable/41343433), where winning in the European cup does not affect club stock share returns while winning in domestic matches does influence positively.

However, a number of “things” might influence share price, and those “things” make “footprints” for enterprise value in the world around us. So, our first goal was to identify as many “footprints” as possible and collect data about them. Data we have been using were data which are not data from financial reports, not data about share prices. Instead, we have been using a spectrum of external (not from club documents or reports) and exclusively publicly available data.

The final goal was to find the algorithm in the standardized model for the spectrum of clubs from the lowest enterprise value in Europe to clubs with the highest enterprise value in Europe (from 0mil € or something less to 3200mil€). The second goal was to find an algorithm which is time resistant as long as possible. Finally, the algorithm was found using different analyses in inferential statistics and we have made the list of TOP100 clubs in Europe by enterprise value (MoF further in text).

Before release, an algorithm in a standardized model was tested in several ways. First, algorithm results were checked by logical enterprise value in reality for the whole span of club values, from lower valued clubs as well as high valued clubs (span should go from 0 to 3200mil€ in the logical sense). The second quality check was confirmed by statistical analysis rules. The third was a comparison with enterprise value calculated by KPMGs spin-off, Football Benchmark (https://www.footballbenchmark.com/library/football_clubs_valuation_the_european_elite_2022); comparing results of enterprise value with KPMGs spin-off, Football Benchmark we receive 99.4% of statistically positive significant correlation between results. The fourth was sales which happened in 2021 in the UEFA report (https://editorial.uefa.com/resources/0272-145b03c04a9e-26dc16d0c545-1000/master_bm_high_res_20220203104923.pdf). Fifth was using data from years before instead of one, last year.

We have been looking on 11 external areas as “footprints” of what’s happening within the club for a period of time. Those areas are 1. success in European competitions (UEFA), 2. investment in the team, 3. social networks, 4. team structure, 5. value of the team, 6. Sale-buying, 7. stadium, 8. attendance, 9. domestic competition, 10. general environment and 11. football environment. Through different stages of research, we have been using in total more than 160 different variables to find the final standardized algorithm. Also, we have been using data about single variables from 5 years before and for some variables even 10 years before.

We have been analysing 227 clubs from 36 European leagues. 31 leagues are from the 1st national tier and 5 leagues are from the 2nd national tier:

| 1 | ESP – La Liga |

| 2 | ESP – La Liga 2 |

| 3 | ENG – Premier league |

| 4 | ENG – Championship |

| 5 | GER – Bundesliga |

| 6 | GER – 2. Bundesliga |

| 7 | FRA – Ligue 1 |

| 8 | FRA – Ligue 2 |

| 9 | ITA – Serie A |

| 10 | ITA – Serie B |

| 11 | TUR |

| 12 | POR |

| 13 | NED |

| 14 | SCO |

| 15 | SVI |

| 16 | ROU |

| 17 | UKR |

| 18 | BEL |

| 19 | RUS |

| 20 | GRE |

| 21 | POL |

| 22 | SER |

| 23 | CRO |

| 24 | AUT |

| 25 | HUN |

| 26 | CZE |

| 27 | DEN |

| 28 | NOR |

| 29 | SWE |

In the analysis were included all clubs from the Big 5 leagues and the best clubs from other listed leagues. More clubs per league were selected from the following leagues: Netherlands, Portugal, Turkey, Belgium, English Championship and Russia (*this year’s results are not affected by the war in Ukraine for Ukraine and Russian clubs).

Of all those clubs, the TOP 100 clubs by enterprise value are:

| Club | State | EV – mil€ | |

| 1 | Real Madrid | SPA | 3139 |

| 2 | FC Barcelona | SPA | 3019 |

| 3 | Manchester United | ENG | 2867 |

| 4 | Liverpool FC | ENG | 2847 |

| 5 | Bayern Munich | GER | 2727 |

| 6 | Manchester City | ENG | 2540 |

| 7 | Chelsea FC | ENG | 2299 |

| 8 | Paris Saint-Germain | FRA | 2053 |

| 9 | Tottenham Hotspur | ENG | 1761 |

| 10 | Arsenal FC | ENG | 1623 |

| 11 | Juventus FC | ITA | 1558 |

| 12 | Borussia Dortmund | GER | 1347 |

| 13 | Atlético de Madrid | SPA | 1116 |

| 14 | Inter Milan | ITA | 1052 |

| 15 | AC Milan | ITA | 766 |

| 16 | Leicester City | ENG | 670 |

| 17 | SSC Napoli | ITA | 655 |

| 18 | Everton FC | ENG | 633 |

| 19 | RB Leipzig | GER | 625 |

| 20 | Bayer 04 Leverkusen | GER | 582 |

| 21 | AS Roma | ITA | 544 |

| 22 | Olympique Lyon | FRA | 542 |

| 23 | AFC Ajax Amsterdam | NED | 469 |

| 24 | AS Monaco | FRA | 451 |

| 25 | Valencia CF | SPA | 431 |

| 26 | FC Porto | POR | 401 |

| 27 | SL Benfica | POR | 377 |

| 28 | Real Sociedad | SPA | 356 |

| 29 | Olympique Marseille | FRA | 350 |

| 30 | Wolverhampton Wanderers | ENG | 346 |

| 31 | Atalanta BC | ITA | 344 |

| 32 | Aston Villa | ENG | 341 |

| 33 | SS Lazio | ITA | 326 |

| 34 | Borussia Mönchengladbach | GER | 312 |

| 35 | Galatasaray A.S. | TUR | 309 |

| 36 | Southampton FC | ENG | 305 |

| 37 | Sevilla FC | SPA | 292 |

| 38 | TSG 1899 Hoffenheim | GER | 274 |

| 39 | Sporting CP | POR | 274 |

| 40 | ACF Fiorentina | ITA | 272 |

| 41 | West Ham United | ENG | 259 |

| 42 | Eintracht Frankfurt | GER | 244 |

| 43 | Crystal Palace | ENG | 242 |

| 44 | Fenerbahce SK | TUR | 241 |

| 45 | Newcastle United | ENG | 239 |

| 46 | Villarreal CF | SPA | 237 |

| 47 | VfL Wolfsburg | GER | 233 |

| 48 | LOSC Lille | FRA | 232 |

| 49 | PSV Eindhoven | NED | 226 |

| 50 | Athletic Bilbao | SPA | 222 |

| 51 | FC Schalke 04 | GER | 221 |

| 52 | Red Bull Salzburg | AUT | 207 |

| 53 | AFC Bournemouth | ENG | 204 |

| 54 | OGC Nice | FRA | 202 |

| 55 | Real Betis Balompié | SPA | 198 |

| 56 | Shakthar Donetsk | UKR | 184 |

| 57 | FC Zenit | RUS | 178 |

| 58 | Torino FC | ITA | 177 |

| 59 | Brighton & Hove Albion | ENG | 174 |

| 60 | Stade Rennais FC | FRA | 174 |

| 61 | US Sassuolo | ITA | 168 |

| 62 | Fulham FC | ENG | 168 |

| 63 | Hertha BSC | GER | 161 |

| 64 | Watford FC | ENG | 155 |

| 65 | Club Brugge KV | BEL | 149 |

| 66 | PFC CSKA Moskva | RUS | 141 |

| 67 | FC Girondins Bordeaux | FRA | 140 |

| 68 | Getafe CF | SPA | 139 |

| 69 | Celtic FC | SCO | 136 |

| 70 | FC Spartak Moskva | RUS | 136 |

| 71 | RSC Anderlecht | BEL | 135 |

| 72 | VfB Stuttgart | GER | 134 |

| 73 | Burnley FC | ENG | 133 |

| 74 | Celta de Vigo | SPA | 132 |

| 75 | SV Werder Bremen | GER | 130 |

| 76 | Feyenoord Rotterdam | NED | 129 |

| 77 | SC Braga | POR | 125 |

| 78 | Udinese Calcio | ITA | 123 |

| 79 | AS Saint-Étienne | FRA | 122 |

| 80 | GNK Dinamo Zagreb | CRO | 122 |

| 81 | 1.FSV Mainz 05 | GER | 120 |

| 82 | Cagliari Calcio | ITA | 119 |

| 83 | West Bromwich Albion | ENG | 119 |

| 84 | Dynamo Kyiv | UKR | 118 |

| 85 | Bologna FC 1909 | ITA | 118 |

| 86 | SC Freiburg | GER | 116 |

| 87 | Leeds United | ENG | 116 |

| 88 | UC Sampdoria | ITA | 111 |

| 89 | Stoke city | ENG | 108 |

| 90 | RCD Espanyol Barcelona | SPA | 106 |

| 91 | Olympiacos Piraeus | GRE | 106 |

| 92 | KRC Genk | BEL | 104 |

| 93 | FC Nantes | FRA | 103 |

| 94 | Swansea city | ENG | 102 |

| 95 | AZ Alkmaar | NED | 101 |

| 96 | Norwich City | ENG | 101 |

| 97 | Montpellier HSC | FRA | 99 |

| 98 | Trabzonspor | TUR | 97 |

| 99 | Lokomotiv Moscow | RUS | 96 |

| 100 | FC Basel 1893 | SVI | 93 |

| TOTAL | 50 414 mil€ |

The total value of TOP 100 clubs is 50,414 bil. € coming from 18 European leagues with two leagues from the 2nd national tier (English Championship and German 2. Bundesliga):

| Tot value clubs-TOP100 | % of league clubs-TOP100 | Average value-TOP100 | ||

| 1 | ENG – Premier league | 18349 | 95% | 882 |

| 2 | SPA | 9386 | 60% | 469 |

| 3 | GER – Bundesliga | 7226 | 67% | 382 |

| 4 | ITA | 6332 | 70% | 317 |

| 5 | FRA | 4468 | 55% | 223 |

| 6 | POR | 1177 | 22% | 65 |

| 7 | NED | 925 | 22% | 51 |

| 8 | ENG – Championship | 700 | 21% | 29 |

| 9 | TUR | 647 | 15% | 32 |

| 10 | RUS | 551 | 25% | 34 |

| 11 | BEL | 387 | 17% | 22 |

| 12 | GER – 2. Bundesliga | 351 | 11% | 20 |

| 13 | UKR | 302 | 13% | 19 |

| 14 | AUT | 207 | 8% | 17 |

| 15 | SCO | 136 | 8% | 11 |

| 16 | CRO | 122 | 10% | 12 |

| 17 | GRE | 106 | 7% | 8 |

| 18 | SUI | 93 | 10% | 9 |

In the above table, values of clubs from a single league were summarized to identify differences between leagues in TOP 100 enterprise value. The highest enterprise value of clubs from a single league in TOP100 is having English Premier league (18349mil€) followed by Spain La Liga (9386mil€), German Bundesliga (7726mil€), Italy Serie A (6332mil€) and French Ligue 1 (4468mil€). English Premier league is pointed out with almost double as value as Spain La Liga. Further on, English Championship is the 8th league (700mil€) in Europe by the value of clubs in TOP100 (German 2. Bundesliga is the 12th league by value (351mil€) of clubs from one league in TOP100).

If we look at the column “% of league clubs-TOP100” we will see again that the English Premier league pointed out, that 95% of clubs from the league, or 19 (Brentford is out) are part of TOP100, followed by Italy Serie A (70%), German Bundesliga (67%), Spain La Liga (60%) and France Ligue 1 (55%).

The column “Average value-TOP100” is the value from all clubs from one league in TOP 100 divided by the number of clubs in the observed league. Leagues with a higher number of clubs will have less average if they have the same number of clubs in the TOP 100 as leagues with fewer clubs in it. Again, the English Premier League is having the highest average (882mil€) followed by Spain’s La Liga (469mil€), German Bundesliga (382mil€), Italian Serie A (317mil€), and France Ligue 1 (223mil€).

Those two columns (“% of league clubs-TOP100”, and “Average value-TOP100”) might indicate the concentration of overall competition and quality of the observed league. A higher percent of league clubs and average might mean higher quality and competition in the league.

If we compare results from the MoF EV list and results from KPMGs spin-off Football Benchmark, the biggest positive differences are with the following clubs (MoF EV – KPMG EV):

| Club | MoF-KPMG (EV) | |

| 1 | Liverpool FC | 291 |

| 2 | FC Barcelona | 205 |

| 3 | AC Milan | 188 |

| 4 | SSC Napoli | 172 |

| 5 | Leicester City FC | 144 |

| 6 | AS Roma | 131 |

It is noticeable that generally Italian clubs are generally higher valued in the Mof EV algorithm than in KPMG’s spin-off, Football Benchmark with the highest percent of the difference in EV from KPMGs (SSC Napoli 36%, AC Milan 32%, and AS Roma 32%).

Biggest negative differences (MoF EV – KPMG EV):

| Club | MoF-KPMG (EV) | |

| 1 | Tottenham Hotspur FC | -151 |

| 2 | Atletico de Madrid | -118 |

| 3 | Atalanta BC | -110 |

| 4 | Sevilla FC | -98 |

| 5 | Paris-Saint Germain FC | -79 |

| 6 | Villareal CF | -66 |

The list of 32 clubs from Football Benchmark is different from Mof EV list. Clubs which are on Mof EV list but not on Football Benchmark one, are RB Leipzig, Bayer 04 Leverkusen, AS Monaco, Real Sociedad, Olympique Marseille and Wolverhampton Wanderers.

The characteristic of this method is that at any moment value of any club in Europe can be calculated based on publicly available data. Although results were tested with KPMG’s spin-off Football Benchmark and sales which really happened, using financial reports for another step of testing the model would be beneficial.

Model by itself reveals what from reality influences most on the enterprise value of the clubs and as such, they can be used for setting relevant and measurable goals for the top management of the club, and for setting KPIs for the top management of the clubs.

Although enterprise value is important when one is investing in the club, estimating the potential of an individual club and the gap which it can fill is of big importance as well. It depends not just on clubs’ inner potential (financial, human resources, community, infrastructure …) but also on football’s external environment and general environment and based on other research results that are interesting in combination with EV research.

Next research…

The quality of human capital in club management is interesting as well as sports staff especially. So, on my list of next research is a calculation of standardized model of quality of management of clubs and standardized model of quality of sport management of the club. Besides that, two research on the “to do” list is research about brand and research on talents.

If you have any comments, we would be grateful to talk about this, what do you think about the possibility of this kind of calculations of enterprise value, what do you think about results and do you have maybe any idea about improving this research (combining with financial reports would, of course, be very useful but here is an idea to use date, not from financial research) and about further research. Special thanks go to Nikica Krnić, Konstantin Kornakov and Josip Korda.

Check out this article on LinkedIn: